Getting Your Business Ready With EIN

There are limitless possibilities for a business that knows how to pay the taxes right. When it comes to things like estate of deceased ein application, there is particular information that you always need to keep in mind. Read further to find out about these details.

Finding your way

The business, whether it is an LLC or a small business, does not have any option to get organized but to consider the existence of an LLC or applying for these tools. What are these and how can they help you in your ventures? First, you have to understand their uses. The best experts will tell you that the presence of these EIN entities that are obtainable through things that include estate of deceased ein application can guide your business toward the proper organization and producing the best stuff around.

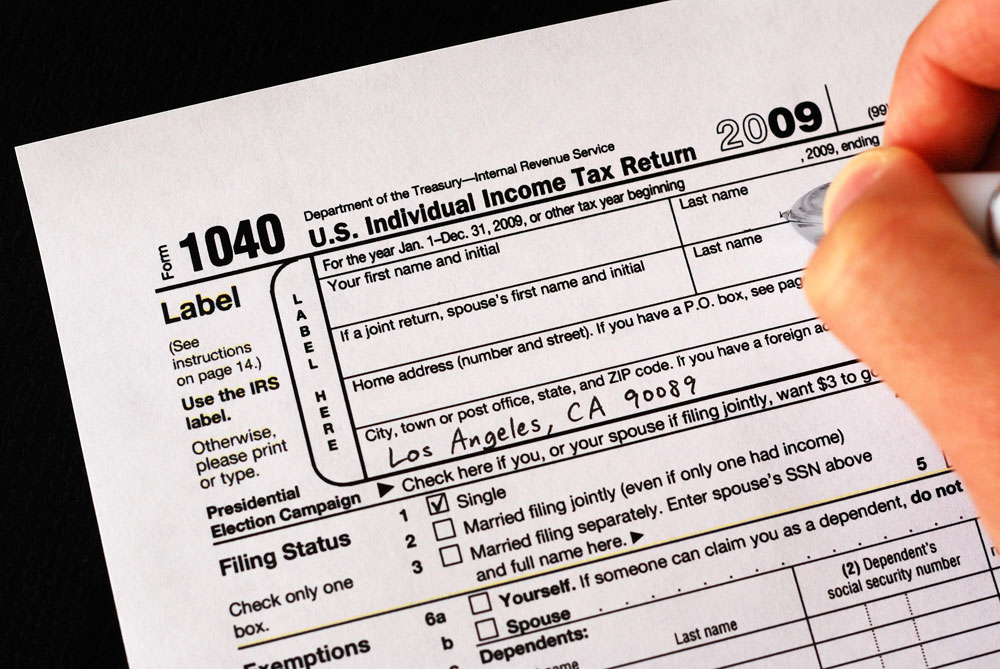

It has been known as the Federal Tax Identification Number or the Employer Identification Number. You can distinguish this from your other ID numbers since it is considered a nine-digit number assigned by the IRS in order to identify the tax accounts of employers and others that have no employees in the team. Previously, the Form SS-4 was used in exchange for the Federal Tax Identification Number, but today, the IRS provides a complete web form where taxpayers and business owners can be able to place this forward. It is important for these business owners to know these ways, no matter how they operate and know the tools needed for these ventures.

After being assigned the identification

Once a taxpayer has been assigned the Federal Tax Identification Number, then the number must be used in the various ownership needs of the business. The IRS should be able to use these numbers to identify those that are required to file various returns for taxes, for corporations, for partnerships, for trusts, for agencies, and for various individuals in relation to the EIN.

Nevertheless, it is important to remember and to keep in mind that the Federal Tax Identification Number does not replace all the ones that you have such as your Social Security Number and thus, must be used for various business transactions.

There are various ways in which you can apply for the Federal Tax Identification Number. First, you might want to use the phone hotline and call the government agencies that award these IDs within particular hours of the day. There are representatives to accommodate you in there.

Then, you should also consider doing these via fax lines and it takes around four business days before the process can provide results. You will still need to fill out certain forms to avoid any duplicate and avoid any issues. Then, you can also try applying for the Federal Tax Identification Number by mail and these can have required forms to fill out. Learn how to take care of your responsibilities with the best taxation methods. For more information, you can also consult with the tax service providers that you can find in your areas.